| 快讯中国与津巴货币互换RMB国际化飞跃加速 |

| 送交者: Pascal 2020年01月17日01:28:49 于 [五 味 斋] 发送悄悄话 |

|

据观察者网1月16日最新消息,非洲国家津巴布韦表示,该国与中国签署了一项具有里程碑意义的货币交换协议,该协议将促进中津两国的进出口交易,并减少该国对其稀缺外汇资源的使用。

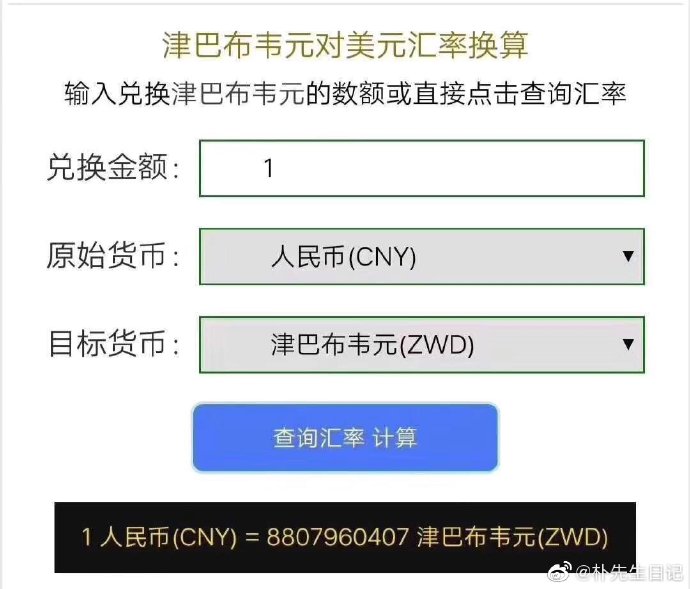

毫无疑问,签署货币互换协议对津巴韦布来说,大有好处。据了解,该货币协议还将允许该国公司可以从中国的银行获得人民币,然后从中国进口原材料。这样的流程对人民币国际化的进程也有所促进。举个例子,该国企业从中国银行获得人民币后,再从中国进口原材料。虽然人民币只是打个转回到中国,但其流程上却相当于增加了一次人民币的国际结算。 数据显示,2018年中国与津巴布韦双边贸易额为13.35亿美元,同比增长1.42%。其中,中国出口4.45亿美元,增长0.41%;进口8.9亿美元,增长1.93%。而2018年中国企业对该国的直接投资额为1512万美元。有分析人士指出,在这份货币互换协议之后,人民币甚至有机会取得美元在其他国家的地位一样,成为该国重要的流通货币。

2020-01-16 http://dy.163.com/v2/article/detail/F31B40AP0519EO06.html

Even small changes in China have global effects. Zimbabwe and China this week signed a currency swap deal aimed at strengthening trade between the two nations. The swap arrangement will enable an investor in China to pay a Chinese business in Zimbabwe which is looking for foreign exchange. The Chinese-owned business in Zimbabwe would release the Zimbabwe dollar equivalent of the US dollar to a local bank account of the payer in China. The local currency is the legal tender for all domestic transactions except for a few business operators particularly those in the tourism sector who can trade in US dollar. Nonetheless, the monetary policies are not attractive to investors specifically when they want to remit their profits back to China as Zimbabwe is facing foreign currency shortages. This currency swap deal, which follows a visit by Chinese foreign minister Wang Yi, will make it easier for Chinese businesses in Zimbabwe to move their funds out of the country. Yi was on an official visit to Zimbabwe and other four African nations including Egypt, Djibouti, Eritrea and Burundi. “The idea is those individuals (Chinese investors) will then swap (currency) so that those who are investing in Zimbabwe are able to give them a domestic currency-which they are bringing in for investment-to pay those who are exiting,” said finance minister Mthuli Ncube in an interview with journalists in Harare at the end of Yi’s visit. The southern African nation, which is experiencing its worst economic crises in decades-with shortages of fuel and other basic commodities, is putting hopes on China to help turn around its struggling economy after efforts failed to have US and EU economic sanctions removed last year. Zimbabwe has joined other nations in Africa including South Africa, Nigeria and Ghana that also have currency swap arrangements with China. But economists in Zimbabwe believe the move will benefit the Chinese while starving the country of much needed foreign currency. This currency swap deal will simplify an exchange control procedure yet it will help the Chinese traders move their business proceeds out of the country but Zimbabweans who might have had access to that money before will not have any more. The potential foreign exchange inflows from investment will be cancelled as the foreign currency does not get into any of the country’s economic systems as it is given to a Chinese company that remits its profits to China. The Zimbabwe Coalition on Debt and Development (ZIMCODD) executive director Janet Zhou told Quartz Africa the only benefit that comes to Zimbabwe from the deal could have been access to foreign currency and external finances at competitive interest rates, however, currency swaps work best in stable economies. “In the case of Zimbabwe where there is hyperinflation, the deal is not going to benefit the country considering that a fixed exchange rate is agreed upon at the beginning of the contract and given the rate at which the local currency is losing value, the principal amount would have lost value by the time the contract matures,” she said. “Moreover, Zimbabwe is currently desperate for foreign currency and it is high likely that the government will offer friendly terms in order to attract the much-needed foreign currency and investment. In any case, China will have more bargaining power considering their global political economy position.” She said ZIMCODD’s fear is the source of Zimbabwe dollar to effect the currency swap since the only available options will be either printing of money or issuance of treasury bills which are highly inflationary. Soon after his meeting with president Emmerson Mnangagwa in Harare on January, 13 this year, Yi claimed China has been Africa’s largest trading partner for 11 years in a row and the former’s stock of “indirect investment has reached $110 billion, and more than 3 700 Chinese enterprises have invested and started business in various parts of Africa”, providing a strong force for a sustained economic growth on the continent.

|

|

|

|

|

|

|

| 实用资讯 | |

|

|

|

|

| 一周点击热帖 | 更多>> |

|

|

|

| 一周回复热帖 |

|

|

|

|

| 历史上的今天:回复热帖 |

| 2019: | 同学们,别再浪费时间在骗子们身上了, | |

| 2019: | 刚在文学城看到的。非法移民翻墙进佩洛 | |

| 2018: | 美国企业4季度盈利报告捷报频传。股市 | |

| 2018: | 赵紫阳逝世13周年,习总行赵路线。 | |

| 2017: | 在马丁路德金日和儿子的对话zt | |

| 2017: | 谭方德:勐拱河谷地战役(中国远征军史 | |

| 2016: | 大顶楞哥的大悲咒,空性灵气 | |

| 2016: | 去他的假共卖国跪台办(国台办) | |

| 2015: | - | |

| 2015: | 今天英文单词:aggrandize 放大 | |