| China needs USA more (雙語) |

| 送交者: 江靈颺 2021年04月02日07:05:21 於 [天下論壇] 發送悄悄話 |

|

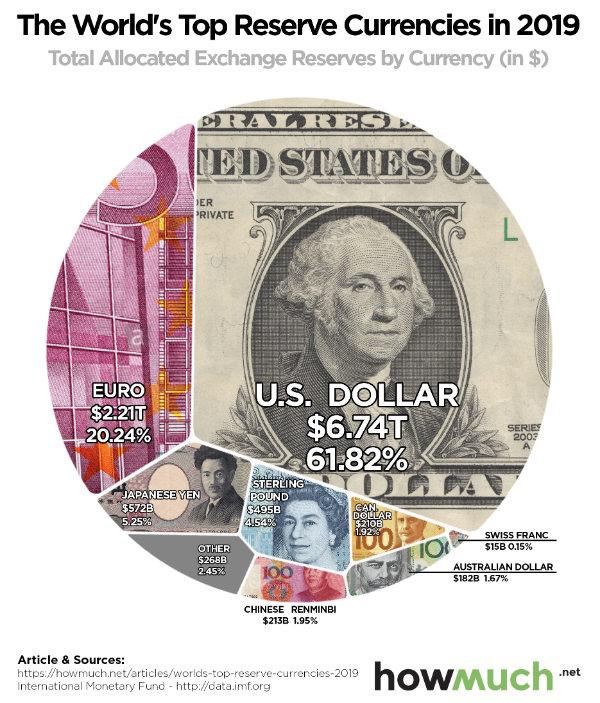

Today, however ravaged by the pandemic, America remains the world’s largest market.* The Beautiful Country is where China and other export countries compete to unload their products. Competition means that production costs have to be cut as deeply as possible. Working people in export countries will be bringing home less and less. Consequently, they will have to consume less and less. At the same time, they will also have to save more and more for a rainy day if they can afford to do so. The downward pressure on the wage comes with the downward pressure on demand. This being the case, a large export country like China has no good reason to invite foreign competition, no matter what and how it says to the contrary in the media. In the meantime, China is more than willing to take in more foreign asset investment (FAI), hoping that more jobs would be created for its hard-pressed youths in particular. But, FAI cuts both ways. Yes, it may be a stimulus to China's job market. On the flip side, however, FAI will also pump more hot air into China's asset bubble. A bubble economy is no fun when it pops. Here is a friendly reminder: Every bubble pops, sooner or later, and probably sooner. China cannot afford to lose America which yields to Beijing huge trade surpluses on top of other benefits such as "tech transfer." That's why Beijing has to take cheap money printed by Washington. This may sound like a leap of faith on China's part, but here is the reality: USD accounts for 61% of the world's currency reserves, compared to RMB's meager share of 2% (International Monetary Fund's 2019 report). The world is struggling with weak demand, day and night. Guess who is smiling? * The EU is arguably the world's largest market, but it is not a nation. It is a large group of European nations. 相較之下、中國更需要美國 今天,飽受疫情煎熬的美國依然是世上最大市場。* 所有出口國都爭相在美市傾銷貨品。競爭的結果、是競相削減生產成本。 出口國的生產者們不免受壓減薪,因而直接削弱其消費力;與此同時,他們又要在能力可及時儘量增加儲蓄應急。出口國的內需能不疲弱,幾稀矣。當然,官方數據是否如實反映,各自判斷好了。(請注意:官方可以大量舉債來大興土木、大煉鋼鐵等,順理成章造成內需上升現象。然而,過去經驗證明此舉引致產能過剩,內部既不能消化,外部更造成供過於求的反效果。) 出口國國內工資的下行壓力,直接導致國內需求的下行壓力。現實如此,象中國這樣的出口大國當然會嚴拒外來競爭,即使口頭上、傳媒間怎樣彈唱開放國內市場的高調。 在不真正開放國內市場的同時,中國又戮力爭取外來投資注進國內資產(FAI),其目的在於興旺消費,推高需求,因而促增職位,減輕對尤其是年輕人的就業壓力。這是可以理解的。問題是,外資會更刺激國內資產炒賣,令資產泡沫越吹越大。如果限定外來投資者必須跟從北京指示投資,又會嚇跑他們。怎麼辦? 外資繼續吹大資產泡沫,泡沫就更快會爆破。不引進外資刺激勞工市場,就業壓力就會不勝負荷。 不管怎樣凸顯強國國力,北京還是要倚賴美國市場,還是要以生產者們的血汗製成品、來換取“美帝”印出來的“廉價”美鈔。現實是、在全球外匯儲備方面,美元占61%,人民幣只占2% (據國際貨幣基金組織2019年度年報,見附圖)。 美國印鈔,除了藉此大搞疫情福利,增加執政黨政治本錢之外,又不愁中國不繼續供應相對廉價的消費品。中國呢,內需不振,就業情況不妙,加上資產急需灌水吹氣,凡此種種,無美鈔不行。無美鈔不行,因為美鈔尚行。又要美鈔,又要在台上劍拔弩張,“美帝”是明白甚至理解的。大家各演其角色罷了,無必要辜負台下傳媒朋友、各界看官們。 最後一問:在復甦官話背後,誰在微笑? *歐盟或許是世上最大巿場,不過它是代表眾邦,本身並非一個國家。

___ Lingyang Jiang |

|

|

|

|

| 實用資訊 | |

|

|

| 一周點擊熱帖 | 更多>> |

| 一周回復熱帖 |

| 歷史上的今天:回復熱帖 |

| 2020: | 鄧小平 | |

| 2020: | 新冠疫症打擊下美中冷戰已經開始? | |

| 2019: | 法廣| 習近平查謠追謠盯上中共中央和國 | |

| 2019: | 夏小強| 揭秘中共紅色滲透和潰而不崩原 | |

| 2018: | 各位公公,我是《老公報》的記者。昨晚 | |

| 2018: | 小英要宣布台灣獨立,不敢宣布台灣獨立 | |

| 2017: | 窩巢,瑞典警察就這德行?哈哈哈哈哈。 | |

| 2017: | 魏橋集團緊急求援:“我們遭到做空勢力 | |

| 2016: | 打倒四人幫是毛生前的戰略部署嗎? | |

| 2016: | 槍決趙紫陽父親的大會 他裝胃病不去參 | |