| 中國中產為何失去信心?(雙語 bilingual )Why China's Middle Class |

| 送交者: 無套褲漢 2024年04月21日16:16:35 於 [天下論壇] 發送悄悄話 |

|

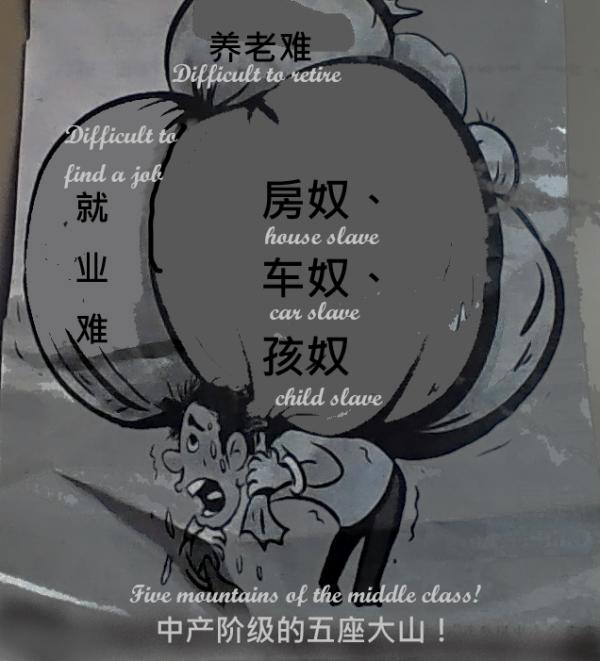

中國中產階層為何失去信心?(雙語 bilingual )華爾街日報中文 程曉農聊天室:中國1億中產開始返貧 未來三年將面臨巨大財務危機…Why China's Middle Class Is Losing Its Confidence (WSJ); China's 100 million middle class are beginning to return to poverty and will face a huge financial crisis in the next three years... 1. 中國中產階層為何失去信心?(雙語 bilingual )華爾街日報中文 (Chinese) 簡體版 2024年4月11日 https://cn.wsj.com/articles/%E4%B8%AD%E5%9B%BD%E4%B8%AD%E4%BA%A7%E9%98%B6%E5%B1%82%E4%B8%BA%E4%BD%95%E5%A4%B1%E5%8E%BB%E4%BF%A1%E5%BF%83-8d2e687b 中國新生一代中產階層在人生的大部分時間裡都認為經濟繁榮是理所當然的。但房地產下滑、股市低迷和更廣泛的經濟衰退已迫使他們面對一個棘手的問題: 中國的繁榮期是否已經徹底結束? 中國民眾正在減少支出,增加儲蓄,遠離高風險投資。 圖片來源:QILAI SHEN/BLOOMBERG NEWS Cao Li 2024年3月26日18:15 CST 更新

三年前,對Blake Xu來說,生活中的一切似乎都很順利。 那時候,這位33歲的企業家和他的家庭已趁着中國房地產蓬勃發展的浪潮購置了多套房產。他的妻子當時正懷着他們的第一個孩子。他剛剛賣掉了一套住宅,並將幾乎一半的賣房所得投入了中國股市。 但從那以後到現在,中國房地產市場進入了長達數年的低迷期,中國基準滬深300指數已跌去了約三分之一的市值,中國經濟變得越來越脆弱,消費者信心萎靡不振,民營部門投資疲軟,青年失業率居高不下。 Xu已經從中國股市撤出了幾乎所有資金。他的下一步可能就是離開中國。 住在上海的Xu說,我不知道未來的路在哪裡;等孩子再大一點,我們打算送他出國,也許我們也會出國。 對中國新生一代中產階層而言,在他們人生的大部分時間裡,他們都覺得經濟繁榮是理所當然的。但房地產下滑、股市低迷和更廣泛的經濟衰退已迫使他們面對一個棘手的問題: 中國的繁榮期是否已經徹底結束? 中國人正在減少支出,增加儲蓄,遠離高風險投資。中國央行的數據顯示,截至2月份,國內家庭儲蓄達到19.83萬億美元,創下歷史最高紀錄。消費者信心接近幾十年來的最低水平。 中國的城市居民和白領階層越來越憂心忡忡,這對中國政府來說可能是個大問題。多年來,中國政府的正當性一直來自於在經濟治理方面的良好聲譽。 現在,這一聲譽漸漸開始遭到質疑。 尋找離場策略 在前領導人鄧小平刪除了毛澤東思想中最激進的內容,並向全球貿易敞開了中國的大門之後,中國經濟開始騰飛轉型,30歲的Hugo Chen就出生在這一轉型期的早期階段。 Chen在富裕的沿海城市深圳長大,曾在英國攻讀碩士學位。2017年,他回到中國從事金融工作,和許多中國人一樣,他決定炒股。他還購買了債券,投資了一些保險產品。 但去年他做出了一個決定:不再投資中國股票。 銀行家Chen曾為一家保險公司管理資金。他比大多數人更了解投資,他也更清楚,繼續投資中國似乎不再是個明智選擇了。 截至2023年底,滬深300指數已連續三年下跌。更糟糕的是,美國、日本和其他地方的股市已經飆升。這本該是屬於中國的世紀,但中國的經濟和股市卻在跑輸其他國家。 “變窮是一回事。在別人致富的同時自己卻變窮,這又是另一碼事,”Chen說。 他將大部分投資轉向購買美國股票的基金。 中國有超過2.2億的散戶投資者,這意味着股市的走勢會對國民心理產生巨大影響。這些小投資者一度被稱作賭徒。經歷過去幾年的低迷之後,他們縮減了投資,逐漸轉向貨幣市場基金等更安全的資產。 房地產行業對信心的損害更大。中國政府大約三年前啟動的房地產去槓桿行動已演變成一場持續多年的危機,將數十家開發商推向了倒閉的邊緣,中國經濟增長的主要引擎之一因此受到衝擊。 2月份,中國最發達城市的二手房價格同比下跌6.3%,創下有記錄以來最大單月同比跌幅。 前述企業家Xu又賣了一套房,他說這個過程非常痛苦。但他並不後悔。他說,手裡有了這筆錢就可以靈活應對,如果情況變得更糟,他可以離開這個國家。 “從情感上講,我對這個國家抱持最好的希望,”Xu說。“但是,坦白講,如果這個領導團隊繼續留任,我必須有一個退出策略,因為前景令人擔憂。” 讓中國官員不安的正是這種情緒。儘管中國政府牢牢掌控着權力,但對公眾情緒十分敏感。 中國民眾有公開表達異見的歷史,包括公開抗議銀行和企業。北京方面至少容忍了一定程度的異見,前提是公民遵循一條首要原則:不要指責中央政府。 但是,一些民眾確實將當前的經濟問題歸咎於中國政府,稱政府對互聯網公司、課外教培、房地產行業的政策發生了180度大轉彎,還實施了嚴格的新冠疫情防控措施,後者對中國民眾的信心造成了持久的傷害。 麻省理工學院(MIT)斯隆管理學院(Sloan School of Management)全球經濟與管理學教授、威爾遜中心(Wilson Center)研究員黃亞生說,當前向低投資、高儲蓄的轉變助長了中國經濟的惡性循環,也就是說,經濟不景氣會削弱信心水平,而反過來,信心不足又會加劇經濟下滑。 他說:“當一個社會形成了某種特定的心理,要想轉變就不容易了。” 從希望到恐懼 現年37歲的Scarlett Hu還記得2014年回到中國的感覺。當時她剛從國外留學回來,在上海的奢侈品行業找到了一份工作。 Hu說,當時,社會上的每個人都充滿希望。周圍瀰漫着一種積極向上的氛圍。Hu說,下班後他們出去放鬆時,相信明天會更好,今天就玩得開心點。 Hu於2017年在上海買了一套公寓,並在2020年,也就是她兒子出生之前,開始購買投資股市的公募基金。她希望這筆錢能幫助支付兒子的教育費用。這在當時似乎是明智之舉:彼時房地產市場欣欣向榮,股市接近創紀錄高位,官方媒體高聲唱多。 現在,她的公寓貶值了15%,她買的公募基金投資組合下跌了35%。 “現在,我們談論的是讓未來更加確定的具體計劃和措施,主要是增加安全感的各種辦法。再也感覺不到那種闖勁了,”她說。 中國政府已採取措施應對經濟下滑,包括放寬面向房地產企業的貸款規定、降低借貸利率以及承諾解決地方政府的債務問題。但中國政府似乎不願採取西方國家政府為應對新冠疫情所採取的直接刺激措施;當時西方國家直接向消費者發放現金的做法帶動消費重新回到了正軌。 今年3月初,中國總理李強表示,中國政府2024年的經濟增長目標是5%左右。最近經濟領域也出現了一些改善的跡象。 但有經濟學家認為,中國政府將很難實現這一目標,在中國的一些人士擔心情況會變得更糟。 一名現年40歲駐北京的股票分析師說,去年8月,她所在的諮詢公司倒閉,她也因此失去了工作。她有兩個孩子需要照顧,丈夫的收入也不穩定,她預計未來的日子會更痛苦。 “每個人都在說,接下來的10年,一年會比一年糟,所以我們應該做好長期艱苦奮鬥的準備,”她說。 * 2. 程曉農聊天室:中國1億中產開始返貧 未來三年將面臨巨大財務危機…(in Chinese) https://www.youtube.com/watch?v=av2yVLvZ8xI 政經最前線 Mar 31, 2024 隨着中國房地產危機的爆發,最近胡潤研究院發布《2024胡潤全球富豪榜》,共有3279位「10億美元」級的富豪企業家上榜,中國雖占814人排行第1,卻比去年減少155位富豪,專家分析,中國富豪財富縮水,其實是這些富豪透過管道將財產轉移到海外做投資跟避險,所以,實際上真正影響到的是走也走不了的中國中產階級。 現在的中國中產階級,很多都是背負按揭而成為負債一族,他們被迫考慮是否要割肉拋出,不求潤只求穩,就因這樣的現象越愈來愈多,中產階級泡沫在中國似乎正在慢慢破滅中,甚至絕大多數的中產階級已經開始「返貧」成「中慘」… 這集我們要討論的是何謂中產?有車有樓的能稱中產嗎?其實,中產是有界定的,全球不同組織或機構,對中產定義都有不同,2024年的中產指標又是如何計算?你在其中嗎?而中產返貧是否只在中國?世界其他國家的中產,若以美中台中產相較,結過會是... ? 含金量最高 最精彩的內容 程曉農博士為您權威剖析 👉 中產資產正在崩塌…中國即將面臨消失的中產! 👉 台灣中產比例高不高? 美國中產正在減少! 👉 美中台中產相比較 👉 中國中產變中慘! * 月光族過年 上聯:年年難過年年過, 下聯:月月愁光月月光。 橫批:小康早至 [Mark Wain 2024-04-14]

Translations: 1. Why China's Middle Class Is Losing Its Confidence The country's economic miracle created an optimistic middle class. A slowdown has left it shaken. Cao Li 03/26/2024 Three years ago, everything seemed to be going right for Blake Xu. The 33-year-old entrepreneur and his family had built a portfolio of properties during China's real-estate boom. His wife was expecting their first child. He had just sold an apartment, and put almost half of the proceeds into the stock market. Since then, the property market has entered a yearslong downturn, the country's benchmark CSI 300 stock index has lost around a third of its value and the economy has become increasingly vulnerable, suffering from moribund consumer confidence, weak private-sector investment and sky-high youth unemployment. Xu has already pulled almost all of his money out of China's stock market. His next exit may be from China itself. “I don't know where the future path lies,” said Xu, who lives in Shanghai. “Once our child grows a little older, we intend to send him abroad, and perhaps we will also go.” For most of their lives, China's new generation of middle-class citizens could take a booming economy for granted. But the property rout, the stock-market slump and the wider economic downturn have forced them to confront a difficult question: Are China's boom years over for good? Chinese citizens are spending less, saving more and shying away from risky investments. Household savings in the country reached $19.83 trillion by February, the highest figure on record, according to data from the central bank. Consumer confidence is near its lowest level in decades. The increasing sense of nervousness among China's city-dwellers and white-collar workers could be a major problem for Beijing. China's government has for years derived legitimacy from its reputation for sound economic management. Now, that reputation looks increasingly shaky. Finding an exit strategy Hugo Chen, 30, was born during the early stages of China's remarkable economic transformation, which came after former leader Deng Xiaoping rolled back the worst excesses of Maoism and opened the doors to global trade. Chen, who was raised in the wealthy coastal city of Shenzhen, studied for a master's degree in the U.K. He moved back to China in 2017 to work in finance and, like many Chinese citizens, decided to play the stock market. He also bought bonds and invested in insurance products. But last year, he made a decision: no more Chinese shares. Chen, a banker, had previously helped an insurance company manage its money. He knew more than most about investing—and China no longer seemed like a smart place to invest money. By the end of 2023, the CSI 300 index had fallen for three years in a row. Even worse, stocks in the U.S., Japan and elsewhere had surged. It was supposed to be China's century, but the economy and the stock market were losing ground to those in other countries. “Becoming poor is one thing. Becoming poor while others get rich is another,” said Chen. He shifted most of his investments into funds that buy U.S. stocks. China has more than 220 million individual investors, meaning stock-market moves can have a big impact on the national psyche. These small investors once had a reputation as gamblers. After the slump of the past few years, they have scaled back their bets and increasingly shifted to safer assets such as money-market funds. The real-estate sector has done even more damage to confidence. What started as an attempt by Beijing to rein in excessive debt in the sector around three years ago has morphed into a multiyear crisis, pushing dozens of developers to the brink of collapse and pulling the rug out from under one of China's main drivers of economic growth. The price of existing homes in China's most developed cities fell 6.3% in February compared with the same month last year—the biggest year-over-year decline on record. Xu, the entrepreneur, sold a second property in a process he described as extremely painful. But he has no regrets: The money will give him the flexibility he needs to leave the country if things get worse, he said. “Emotionally, I hope for the best for this country,” said Xu. “However, if this team of leaders stays, to be frank, I have to have an exit strategy, as the outlook is worrisome.” That is precisely the kind of sentiment that will unsettle officials in Beijing. Although China's government keeps a tight grip on power, it is acutely sensitive to the public mood. China's population has a history of public displays of dissent, including public protests against banks and companies. Beijing has tolerated at least a degree of dissent, as long as its citizens follow one overriding principle: Don't blame the central government. But some people in the country do blame Beijing for the current economic troubles, pointing to policy U-turns on internet companies, private education and real estate, and a strict approach to containing Covid-19 that has dealt lasting damage to confidence in the country. The shift toward low investment and high savings is fueling a vicious cycle, where the economic slump erodes confidence levels and, in turn, low confidence worsens the downturn, said Yasheng Huang, professor of global economics and management with MIT Sloan School of Management and a fellow at the Wilson Center. “When a society settles on a particular psychology, it's not easy to shift,” he said. From hope to fear Scarlett Hu, 37, remembers how it felt to be back in China in 2014. She had just returned from studying abroad, and took a job in Shanghai's luxury-goods sector. “At that time everyone in the society was full of hope. There was this promising sentiment around,” said Hu. “When we went out to relax after work, we believed that tomorrow would be better and let's have fun today.” Hu bought an apartment in Shanghai in 2017 and started buying mutual funds that invest in the stock market in 2020, before the birth of her son. She hoped the money would help pay for his education. At the time, it seemed like a smart bet: The real-estate market was booming, and stocks were nearing a record high, cheered on by China's bullish state media. Her apartment has now lost 15% of its value, and her mutual-fund portfolio is down 35%. “Now we talk about concrete plans and measures to secure a more certain future, focusing on ways to enhance our sense of security. You don't feel that kind of ambition any more,” she said. China's government has taken steps to tackle the downturn, including easing lending rules for battered real-estate firms, cutting borrowing rates and pledging to resolve the debt problems of local governments. But Beijing appears reluctant to adopt the sort of direct stimulus Western governments embraced in the wake of Covid-19, when direct payments to consumers helped get spending back on track. In early March, Chinese Premier Li Qiang said the government was targeting growth of around 5% for 2024, and there have been recent signs of improvement. But economists think Beijing will find it difficult to hit this growth target, and some people in the country worry that things are about to get worse. A 40-year-old equity analyst based in Beijing said she lost her job last August when the consulting firm she worked for closed. She has two children to care for, her husband's income is unstable, and she is bracing herself for more pain to come. “Everyone is saying that this year might still be the best in the next decade, so we should be prepared for a long period of hardship,” she said. Write to Cao Li at li.cao@wsj.com 2. Cheng Xiaonong Chat Room: China's 100 million middle class are beginning to return to poverty and will face a huge financial crisis in the next three years... (in Chinese) https://www.youtube.com/watch?v=av2yVLvZ8xI The forefront of politics and economy Mar 31, 2024 With the outbreak of the real estate crisis in China, the Hurun Research Institute recently released the "2024 Hurun Global Rich List". A total of 3,279 billionaire entrepreneurs are on the list. Although China ranks first with 814 people, it is less than Last year, there were 155 rich people. According to expert analysis, the shrinking wealth of China's rich is actually due to these rich people transferring their property overseas through channels for investment and risk hedging. Therefore, what is actually really affected is the Chinese middle class who cannot leave. Many of the current Chinese middle class are burdened with mortgages and have become indebted. They are forced to consider whether to cut off their flesh and sell it. They do not seek profit but stability. Because this phenomenon is becoming more and more common, the middle class bubble seems to be in China. It is slowly being destroyed, and even the vast majority of the middle class has begun to "return to poverty" and become "middle miserable"... What we are going to discuss in this episode is what is the middle class? Can those who own cars and houses be called middle class? In fact, the middle class is defined. Different organizations or institutions around the world have different definitions of the middle class. How is the middle class index calculated in 2024? Are you one of them? Is the return of the middle class to poverty only in China? If the middle class in other countries in the world is compared with the middle class in the United States, China and Taiwan, what will be the result... ? The most valuable and exciting content, Dr. Cheng Xiaonong, will give you an authoritative analysis 👉 The assets of the middle class are collapsing... China The middle class is about to disappear! 👉 Is the proportion of the middle class in Taiwan high? The middle class in the United States is shrinking! 👉 Comparing the middle class in the United States, China and Taiwan👉 The middle class in China has become miserable! 3. Moonlight Clan celebrates the New Year First couplet: Every year is sad and every year passes; Second line: The moon is full of sorrow and light. Hengpi: Well-off people arrive early [Mark Wain 2024-04-14] |

|

|

|

|

|

|

| 實用資訊 | |

|

|

|

|

| 一周點擊熱帖 | 更多>> |

|

|

|

| 一周回復熱帖 |

|

|

|

|

| 歷史上的今天:回復熱帖 |

| 2023: | 主權與治權 | |

| 2023: | 哈哈哈,我都還沒被螞蟥咬過。以前聽說 | |

| 2022: | 中國社會的納粹文化 | |

| 2022: | 普京所宣布的“重大勝利”到底是怎麼回 | |

| 2021: | 國民黨 | |

| 2021: | 外交老手拜登上台百日新政組合拳,打的 | |

| 2020: | 陶傑| 懷念江青女士 | |

| 2020: | 郭文貴是怎麼圈錢騙錢的? | |

| 2019: | 大小兩岸時局戰和吟(Zt朗) | |

| 2019: | 凡是有良心和人心的人看看這狗漢奸說什 | |