| 古風對過去的回顧與未來的展望之總結 |

| 送交者: 遠古的風 2013年01月14日10:11:36 於 [股市財經] 發送悄悄話 |

|

【古風按】Kyle Bass 前不久在2012年AmerCatalyst會議的主題演講(http://youtu.be/JUc8-GUC1hY)里說出了如下的話: 在2011年12月29日歲末的一篇有關中國北斗資訊的最後,古風留下了如下的按語: 2011年的確是個值得大書特書的一年。在西方一片衰敗情景中,中國繼續保持着高速發展的健康勢頭。中國的北斗趕在這個歲末開始了試運行,瞄準的其實不是什麼商業上的效益,而是對美國豎起了金箍棒,明確地昭示:處於經濟崩潰邊緣的美國不要把戰爭的禍水引入中國周遭的亞洲區域。如果發生中美間的直接或間接熱戰,美國現在與中國基本上處於同一技術水平之上,到時候美國及其嘍囉們就會吃不了兜着走了。在另一方面,中國開始北斗的試運行正好跟北韓的領袖金正日逝世、日本的新任首相野田佳彥訪華、美國大力顛覆敘利亞、伊朗與俄國,美國大張旗鼓推動TPP,美國高調屯兵澳大利亞,美歐債務危機進一步惡化,歐元瀕臨瓦解,美國預算再陷僵局,美歐經濟毫無起色,西方平民示威暴亂日益嚴重等諸多重大國際事件都湊到了一起,這難道僅僅是個巧合嗎?如果仔細把握世界局勢的脈絡,就會發現人類歷史基本上沿着如下的劇本在演繹:一強稱霸→經濟軍事競爭→列強爭霸→貨幣戰爭→貿易戰爭→肉體戰爭→熱戰決出新霸主→新的輪迴開始。自從2007/08年西方爆發金融危機以來,整整4年過去了,整個世界於2010年進入了全球貨幣戰爭的階段,現在已經處於全球貿易戰爭的臨界點,2012年將是人類走向長久和平還是第三次世界大戰的關鍵一年。中國趕在2011年末把北斗投入試運行、在2012年底讓北斗達到美國GPS同樣的精度,的確不是僅僅在從事民用商業競爭而已。在2011年歲末,古風許下新年願望:祈禱中國在軍事與經濟上能夠繼續快速發展,徹底打消西方非和平勢力的戰爭圖謀,給全世界人民帶來和平繁榮! 到2012年4月22日,在一篇介紹和總結《時輪》的短文中,古風留下了如下的文字: 對於大家理解現在和未來15-20年將要發生的一切都會大有助益。比如,當您讀到《時輪三部曲》的第三部末尾時就會看到文章的作者預計:在未來的15年內中美間會爆發世界大戰。再比如《時輪三部曲》的第一部和前傳都明確地說明:自從2008年以來,美國已經進入時輪的第四個階段——全面危機。從1773年以來,美國已經經歷過了三次“全面危機”,每一次全面危機都伴隨着整個社會的全面戰爭: American Revolution (1773–1794),美國獨立戰爭 如果中國在習李十年後的下一代最高領導層沒有足夠的智慧與忍辱力,中美間的全面戰爭就極有可能在10-15年內發生;如果中國的最高領導層不陪着美國一同毀滅,那麼美國國內就會發生自毀的分裂戰爭。第一種選擇將是整個人類文明的末日,第二種選擇將是美聯邦的謝幕show。可是,不論哪一種結局在美國的華人都完了。網友們要記住二戰時日裔美國人和猶太裔德國人的遭遇哦。 同時,古風個人預計5年內,金融超級炸彈(那700萬億的衍生壞賬)就會被引爆了。 最後,古風祝願各位網友能夠成功度過這一面臨整個人類文明的劫難! 古風在2012年10月21日給網友“mzl9876”的回覆中寫到: 在下估計:不到亡國,中國絕不會跟日本開戰;即便日本人登(釣魚)島,中國也不會打起來。現在還不是打的時候,就如同快開的水,雖然很響,可是還沒有到最後即將爆開的階段(水真要開之前的一段極短的時間,水會突然由很響變得不響了)。您回去現煮一壺水,看看在下描述得是否準確。哈哈…… 預計習上台後,會大力推動官員的財產公開制度,打擊貪腐現象,同時也會加大緩和貧富差距的力度。中國的下一個5年將會逐漸走上和諧之路,為10年後穩健地成為全球霸主打下堅實的基礎。

China is Getting Ready for the Incoming World War If there were ever a sign that something is amiss, this may very well be it.

If a 400% year-over-year increase in rice stockpiles isn’t enough to convince you the Chinese are preparing for a significant near-term event, consider that in Australia the country’s two major baby formula distributors have reported they are unable to keep up with demand for their dry milk formula products. Grocery stores throughout the country have been left empty of the essential infant staple as a result of bulk exports by the Chinese.

We’d be more apt to believe the Chinese were panic-buying baby formula had the Chinese milk scandal occurred recently. The problem is that it happened four years ago. Are we to believe the Chinese are just now realizing their baby food may be tainted? In addition to the apparent build-up in food stocks, the Chinese are further diversifying their cash assets (denominated in US Dollars) into physical goods. In fact, in just a single month in 2012, the Chinese imported and stockpiled more gold than the entirety of the gold stored in the vaults of the European Central Bank (and did we mention they did this in one month?). Their precious metals stockpiles have grown so quickly in recent years that Chinese official holdings remain a complete mystery to Western governments and it’s rumored that the People’s Republic may now be the second largest gold hoarding nation in the world, behind the United States.

But the Chinese aren’t just buying precious metals. They’re rapidly acquiring industrial metals as well.

The official explanation, that China is preparing stockpiles in anticipation of an economic recovery, is quite amusing considering that just 8 months ago Reuters reported that China had an oversupply, so much so that their storage facilities had run out of room to store all the inventory!

Now, why would China be stockpiling even more iron (and setting 15 month price highs in the process) if they had massive amounts of excess inventory just last year? Something tells us this has nothing to do with an economic recovery, or even economic theory in terms of popular mainstream analysis. Why does China need four times as much rice year-over-year? Why purchase more iron when you already have a huge surplus? Why buy gold when, as Federal Reserve Chairmen Ben Bernanke suggests, it is not real money? Why build massive cities capable of housing a million or more people, and then keep them empty? It doesn’t add up. None of it makes any sense. Unless the Chinese know something we haven’t been made privy to. Is it possible, in a world where hundreds of trillions of dollars are owed, where the United States indirectly controls most of the globe’s oil reserves, and where super powers have built tens of thousands of nuclear weapons and spent hundreds of billions on weapons of war (real ones, not those pesky semi-automatic assault rifles), that the Chinese expect things to take a turn for the worse in the near future? The Chinese are buying physical assets – and not just representations of those assets in the form of paper receipts – but the actual physical commodities. And they are storing them in-country. Perhaps they’ve determined that U.S. and European debt are a losing proposition and it’s only a matter of time before the financial, economic and monetary systems of the West undergo a complete collapse. At best, what these signs indicate is that the People’s Republic of China is expecting the value of currencies ( they have trillions in Western currency reserves) will deteriorate with respect to physical commodities. They are stocking up ahead of the carnage and buying what they can before their savings are hyper-inflated away. At worst, they may very well be getting ready for what geopolitical analyst Joel Skousen warned of in his documentary Strategic Relocation, where he argued that some time in the next decade the Chinese and Russians may team up against the United States in a thermo-nuclear showdown. Hard to believe? Maybe. But consider that China is taking measures now, in addition to their stockpiling, that suggest we are already in the opening salvos of World War III. They have already taken steps to map our entire national grid – that includes water, power, refining, commerce and transportation infrastructure. They’re directly involved in hacking government and commercial networks and are responsible for what has been called the greatest transfer of wealth in the history of the world. Militarily, the PRC has been developing technology like EMP weapons systems, capable of disabling our military fleets and the electrical infrastructure of the country as a whole, and has been caught red-handed manufacturing fake computer chips used in U.S. Navy weapons systems. If you still doubt China’s intentions and expectations, look to other governments, including our own, for signs that someone, somewhere is planning for horrific worst-case scenarios:

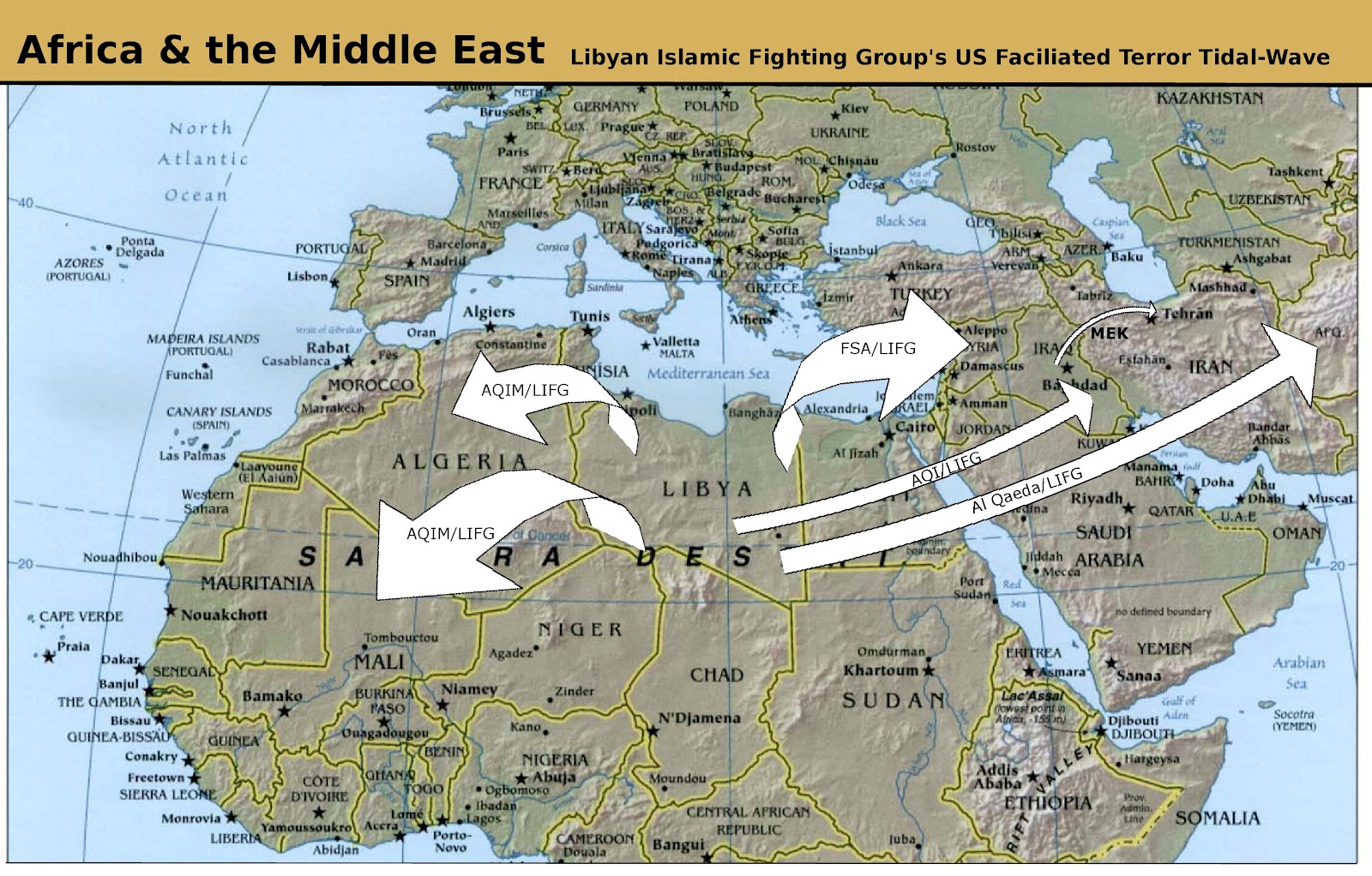

Perhaps there’s a reason why former Congressman Roscoe Bartlett has warned, “those who can, should move their families out of the city.” As Kyle Bass noted in a recent speech, “it’s just a question of when will this unravel and how will it unravel.” Given how similar events have played out in history, we think you know how this ends. Governments around the world are stockpiling food, supplies, precious metals and arms, suggesting that there is foreknowledge of an impending event. Should we be doing the same? In Africa US is Already Fighting with China America Sets Its Sights On Controlling African Resources … And Reducing Chinese InfluenceThe U.S. is sending troops to 35 African nations under the guise of fighting Al Qaeda and related terrorists. Democracy Now notes:

NPR reports:

Glenn Ford writes:

Timothy Alexander Guzman argues:

In a must-watch interview, Dan Collins of the China Money Report agrees that the purpose of the deployment is to challenge China’s rising prominence in Africa:

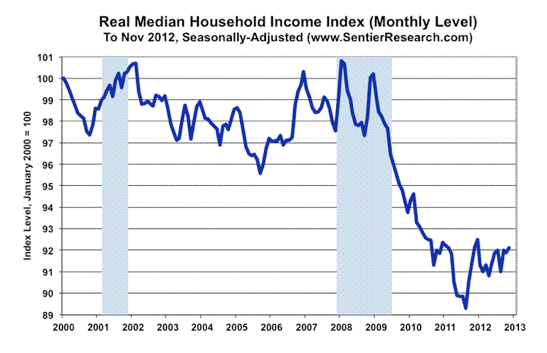

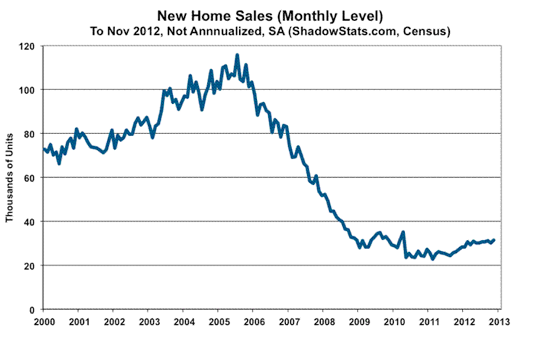

(Indeed, the U.S. considers economic rivalry to be a basis for war). In reality – as we’ve repeatedly noted – the U.S. sends in the military to fight “terrorists” in any country which has resources we want (and see this). And the U.S. is not shy about backing our “mortal enemies” to topple those standing between us and resources we pine for. Anthony Carlucci argues that the overthrow of Gaddafi (largely through American support of terrorists) was really the opening salvo in the war for African resources: Chinese November Gold Imports Soar To 91 Tons; 2012 Total 720 Tons Regular readers are familiar with our monthly series showing the inexorable surge in Chinese gold imports. It is time for the November update, and it's a doozy: at 90.8 tons, this was the second highest gross import number of 2012, double the 47 tons imported in October (which many saw, incorrectly, as an indication of China's waning interest in the yellow metal), and brings the Year to Date total to a massive 720 tons of gold through November. If last year is any indication, the December total will be roughly the same amount, and will bring the total 2012 import amount to over 800 tons, double the 392.6 tons imported in 2011. Indicatively, should the full year total import number indeed print in the 800 tons range, it will mean that in one year China, whose official reserve holdings are still a negligible 1054 (and realistically at least double, if not triple, this number), will have imported more gold than the official holdings of Japan, last pegged at 765.2 tons (and well more than the ECB's 502.1 tons). Finally, putting the November import number in context, so far in 2012 China has bought some $39 billion worth of gold. How many US Treasurys has China bought in the same time period? Under $10 billion. Finally, let's not forget that recently China surpassed South Africa as the world's biggest producer of gold with annual output in the hundreds of tons. Add the net imports number to this total (which amounted to some 281 tons in 2012 according to Bloomberg) and one can get a sense of how big China's appetite for hard assets, instead of trillion dollar coin-backed "promises of repayment", has become. Washington’s Hegemonic Ambitions Are Not in Sync With Its Faltering Economy In November the largest chunk of new jobs came from retail and wholesale trade. Businesses gearing up for Christmas sales added 65,700 jobs or 45% of November’s 146,000 jobs gain. With December sales a disappointment, these jobs are likely to reverse when the January payroll jobs report comes out in February. Family Dollar Stores CEO Howard Levine told analysts that his company’s customers were unable to afford toys this holiday season and focused instead on basic needs such as food. Levine said that his customers “clearly don’t have as much for discretionary purchases as they once did.” For December’s new jobs we return to the old standbys: health care and social assistance and waitresses and bartenders. These four classifications accounted for 93,000 of December’s new jobs, 60% of the 155,000 jobs. Obviously, the economy is not going anywhere except down. It takes approximately 150,000 new jobs each month to stay even with population growth and new entrants into the work force. Few of the jobs that are being created pay well, and the constant, consistent demand for more poorly paid waitresses, bartenders and hospital orderlies is difficult to believe. If Americans cannot afford toys for their kid’s Christmas, how can they afford to eat and drink out? Media spin seeks to create a recovery out of thin air, but these graphs from John Williams (shadowstats.com) show the reality: Keep in mind that the 7.8% unemployment rate (U.3) that is headlined by the financial media does not include discouraged workers who have ceased to look for jobs. The government’s U.6 rate includes workers who have been too discouraged to seek work for less than a year. This rate of unemployment is 14.4%, almost twice the U.3 rate that the media prefers to report. In 1994 the US government defined out of existence unemployed Americans who have been discouraged from finding work for more than a year. John Williams estimates the long term discouraged workers. When his estimate is added to the U.6 measure, the US unemployment rate stands at 23%, three times the reported rate. The rate of unemployment is so high because millions of US jobs have been offshored and given to Chinese, Indian, and other workers and because remaining businesses have been concentrated in few hands in violation of the anti-trust laws. (Go to this URL to see the concentration of the media: http://frugaldad.com/2011/11/22/media-consolidation-infographic/ ) We need to be concerned about a financial media and economics profession that believes a recovery is underway when the unemployment rate is so high and the real median income is so low. It is a mystery how any set of policymakers could possibly have believed that a country whose economy is driven by consumer expenditures can continue to expand when the jobs that produce the incomes that drive the economy are given to foreigners in foreign lands. Essentially, Americans were told a packet of lies designed to win their gullible acceptance to an economy that produces high returns for Wall Street, shareholders, and corporate executives at the expense of everyone else in the country. The wage savings from the use of overseas labor means large rewards for the one percent and Family Dollar customers who cannot afford to buy toys for their children at Christmas. http://www.economist.com/blogs/graphicdetail/2013/01/daily-chart-7 (US's) Unhealthy Outcomes America fares badly in a comparison of health measures in rich countries IT IS hardly news that America spends more on health care than any other country. Nor is it news that this money fails to make Americans healthy. But a new report from America’s Institute of Medicine and National Research Council illuminates the many ways in which America’s health lags that of other rich countries and tries to explain why. Health spending reached $2.7 trillion in 2011, equal to 17.9% of America’s GDP (and more than the entire GDP of Britain). Yet America performs poorly on nearly every measure. Life expectancy has risen, but not as quickly as among America’s peers. In a ranking of 17 rich countries, America’s death rate from non-communicable diseases is higher than any country except Denmark. The statistics are particularly bleak for the young. America has the highest infant-mortality rate of the 17 rich countries examined. Its teenagers are more likely to become pregnant or die from a car accident or violence. Shockingly, deaths among under-50s account for roughly two-thirds of the gap in life expectancy between American men and those in comparable countries. The old fare better. If an American is lucky enough to reach 75, he can expect to live longer than his peers elsewhere. America is obviously doing something wrong. But what, exactly? That is the $2.7 trillion question. The report offers a few tentative answers. The structure of America’s health system is partly to blame. Different types of care are siloed, which is inefficient. Doctors are paid for providing lots of services, rather than keeping patients well. There are fewer general practitioners. More citizens lack insurance and more find care unaffordable. The gap might also be explained by behaviour. Americans may smoke and drink less than people in other countries, but they tend to eat more, take more drugs, own more guns and are more often in drunk-driving accidents. They have sex younger, with more partners, using protection less frequently. But circumstance and behaviour cannot explain all. Interestingly, even rich, insured, non-smoking, normal-weight Americans are less healthy than adults with similar traits in similar countries. How all these factors relate to one another is difficult to untangle. Even harder is getting politicians to agree on which problem to tackle first. Barack Obama’s health reforms, which will take full effect in 2014, expand insurance and start to tweak doctors’ perverse incentives. This new report is a reminder of how much is left to be done. |

|

|

|

|

|

|

| 實用資訊 | |

|

|

|

|

| 一周點擊熱帖 | 更多>> |

|

|

|

| 一周回復熱帖 |

|

|

|

|

| 歷史上的今天:回復熱帖 |

| 2011: | 中國上市公司三準則? | |

| 2011: | love陽光:買進與賣出的界線 | |

| 2010: | 汪翔:IT'S Time to BUY GOOG? | |

| 2010: | Build up a Responsible American Soci | |

| 2009: | Again, buying in a bear market | |

| 2009: | 喬布斯,是我心中偶像級的大師。 | |