| 快訊中國與津巴貨幣互換RMB國際化飛躍加速 |

| 送交者: Pascal 2020年01月17日01:28:49 於 [五 味 齋] 發送悄悄話 |

|

據觀察者網1月16日最新消息,非洲國家津巴布韋表示,該國與中國簽署了一項具有里程碑意義的貨幣交換協議,該協議將促進中津兩國的進出口交易,並減少該國對其稀缺外匯資源的使用。

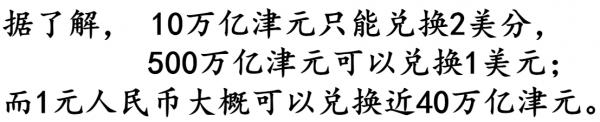

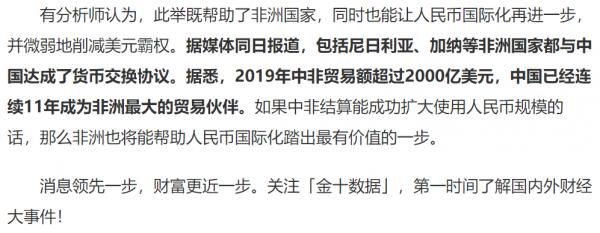

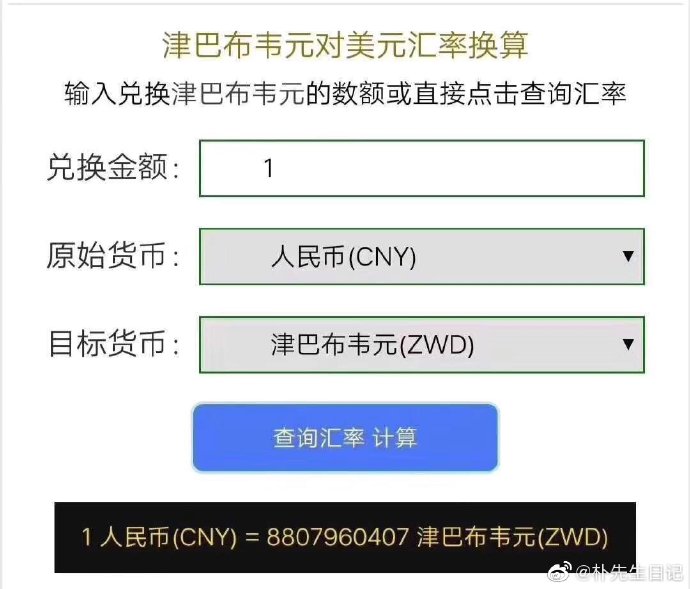

毫無疑問,簽署貨幣互換協議對津巴韋布來說,大有好處。據了解,該貨幣協議還將允許該國公司可以從中國的銀行獲得人民幣,然後從中國進口原材料。這樣的流程對人民幣國際化的進程也有所促進。舉個例子,該國企業從中國銀行獲得人民幣後,再從中國進口原材料。雖然人民幣只是打個轉回到中國,但其流程上卻相當於增加了一次人民幣的國際結算。 數據顯示,2018年中國與津巴布韋雙邊貿易額為13.35億美元,同比增長1.42%。其中,中國出口4.45億美元,增長0.41%;進口8.9億美元,增長1.93%。而2018年中國企業對該國的直接投資額為1512萬美元。有分析人士指出,在這份貨幣互換協議之後,人民幣甚至有機會取得美元在其他國家的地位一樣,成為該國重要的流通貨幣。

2020-01-16 http://dy.163.com/v2/article/detail/F31B40AP0519EO06.html

Even small changes in China have global effects. Zimbabwe and China this week signed a currency swap deal aimed at strengthening trade between the two nations. The swap arrangement will enable an investor in China to pay a Chinese business in Zimbabwe which is looking for foreign exchange. The Chinese-owned business in Zimbabwe would release the Zimbabwe dollar equivalent of the US dollar to a local bank account of the payer in China. The local currency is the legal tender for all domestic transactions except for a few business operators particularly those in the tourism sector who can trade in US dollar. Nonetheless, the monetary policies are not attractive to investors specifically when they want to remit their profits back to China as Zimbabwe is facing foreign currency shortages. This currency swap deal, which follows a visit by Chinese foreign minister Wang Yi, will make it easier for Chinese businesses in Zimbabwe to move their funds out of the country. Yi was on an official visit to Zimbabwe and other four African nations including Egypt, Djibouti, Eritrea and Burundi. “The idea is those individuals (Chinese investors) will then swap (currency) so that those who are investing in Zimbabwe are able to give them a domestic currency-which they are bringing in for investment-to pay those who are exiting,” said finance minister Mthuli Ncube in an interview with journalists in Harare at the end of Yi’s visit. The southern African nation, which is experiencing its worst economic crises in decades-with shortages of fuel and other basic commodities, is putting hopes on China to help turn around its struggling economy after efforts failed to have US and EU economic sanctions removed last year. Zimbabwe has joined other nations in Africa including South Africa, Nigeria and Ghana that also have currency swap arrangements with China. But economists in Zimbabwe believe the move will benefit the Chinese while starving the country of much needed foreign currency. This currency swap deal will simplify an exchange control procedure yet it will help the Chinese traders move their business proceeds out of the country but Zimbabweans who might have had access to that money before will not have any more. The potential foreign exchange inflows from investment will be cancelled as the foreign currency does not get into any of the country’s economic systems as it is given to a Chinese company that remits its profits to China. The Zimbabwe Coalition on Debt and Development (ZIMCODD) executive director Janet Zhou told Quartz Africa the only benefit that comes to Zimbabwe from the deal could have been access to foreign currency and external finances at competitive interest rates, however, currency swaps work best in stable economies. “In the case of Zimbabwe where there is hyperinflation, the deal is not going to benefit the country considering that a fixed exchange rate is agreed upon at the beginning of the contract and given the rate at which the local currency is losing value, the principal amount would have lost value by the time the contract matures,” she said. “Moreover, Zimbabwe is currently desperate for foreign currency and it is high likely that the government will offer friendly terms in order to attract the much-needed foreign currency and investment. In any case, China will have more bargaining power considering their global political economy position.” She said ZIMCODD’s fear is the source of Zimbabwe dollar to effect the currency swap since the only available options will be either printing of money or issuance of treasury bills which are highly inflationary. Soon after his meeting with president Emmerson Mnangagwa in Harare on January, 13 this year, Yi claimed China has been Africa’s largest trading partner for 11 years in a row and the former’s stock of “indirect investment has reached $110 billion, and more than 3 700 Chinese enterprises have invested and started business in various parts of Africa”, providing a strong force for a sustained economic growth on the continent.

|

|

|

|

|

|

|

| 實用資訊 | |

|

|

|

|

| 一周點擊熱帖 | 更多>> |

|

|

|

| 一周回復熱帖 |

|

|

|

|

| 歷史上的今天:回復熱帖 |

| 2019: | 同學們,別再浪費時間在騙子們身上了, | |

| 2019: | 剛在文學城看到的。非法移民翻牆進佩洛 | |

| 2018: | 美國企業4季度盈利報告捷報頻傳。股市 | |

| 2018: | 趙紫陽逝世13周年,習總行趙路線。 | |

| 2017: | 在馬丁路德金日和兒子的對話zt | |

| 2017: | 譚方德:勐拱河谷地戰役(中國遠征軍史 | |

| 2016: | 大頂楞哥的大悲咒,空性靈氣 | |

| 2016: | 去他的假共賣國跪台辦(國台辦) | |

| 2015: | - | |

| 2015: | 今天英文單詞:aggrandize 放大 | |