| 从郭贵人到安邦吴被抓,习包子的锅里任何人都可以是肉饼 |

| 送交者: 福禄 2017年06月15日10:56:41 于 [五 味 斋] 发送悄悄话 |

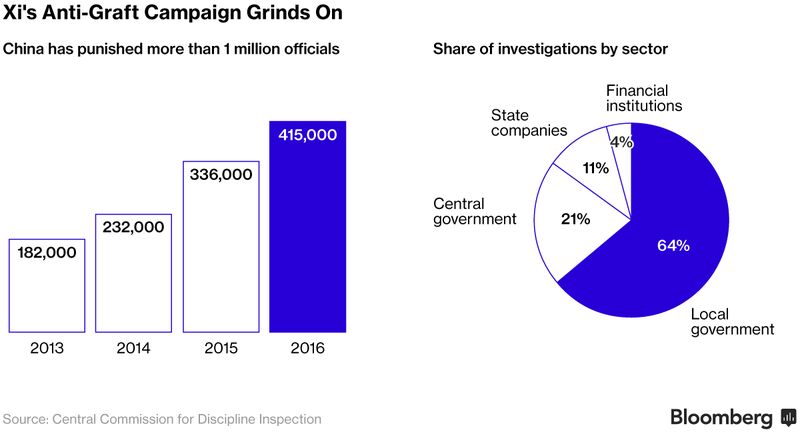

from bloombergAnbang Shows Billionaires Should Be Nervous in Xi's New ChinaChina’s billionaires are learning yet again that wealth and power are no longer enough to keep them out of trouble. Anbang Insurance Group Co. said Tuesday that Wu Xiaohui -- its chairman, and one of China’s most aggressive overseas dealmakers -- was unable to perform his duties for personal reasons. Caijing Magazine, a reputable finance and business publication, said he was taken away for questioning. Wu is the latest example of the new reality in Xi Jinping’s China: Almost anyone could be hauled away at any time, regardless of cash or connections. Since Xi became party chief in 2012, billionaires and senior Communist Party members alike have been among those rounded up for questioning over corruption, financial crimes or other misdeeds. While it’s unclear if Wu did anything wrong, his mysterious absence reinforces the strength of Xi, who’s already one of China’s most powerful leaders since Mao Zedong. At the same time, it risks leading to pushback against Xi ahead of a twice-a-decade leadership reshuffle just a few months away -- the most significant political event in China’s opaque, one-party system. Later that month, after the worst losses this year in Shanghai-traded shares, Xi chaired a meeting of the party’s elite Politburo that included the central bank governor and chiefs of the nation’s market watchdogs. His message: Financial security was the basis of a stable, healthy economy. Other high-profile figures -- including several billionaires -- have found themselves in the cross hairs of the government. Prominent financier Xiao Jianhua was taken by agents from a Hong Kong hotel earlier this year and presumed to have been brought back to China, according to local media reports. Guo Guangchang, the chairman of Fosun International Ltd., another major Chinese firm that has been part of the overseas buying spree in recent years, also disappeared in 2015 for a while to assist authorities in an investigation. While he resurfaced after a few days, it wasn’t before concerns about his fate impacted the company’s shares.

Tycoon Miles Kwok, also known as Guo Wengui, shows the potential risks for Xi. Executives of a company he controls stood trial this month on charges of loan and foreign exchange fraud, the state-owned Xinhua News Agency reported, after Chinese authorities issued a request to Interpol for Kwok’s arrest in April. Kwok fled the country after the fallout from a corporate feud in 2014 with Peking University Founder Group, a state-owned company. Now in the U.S., Kwok has attracted nearly a quarter-million followers on Twitter with threats to expose corruption among senior members of the Communist Party. Many wealthy Chinese are looking to follow Kwok overseas. Mainland Chinese citizens make up about 80 percent of applicants for EB-5 visas, a program that grants wealthy foreigners green cards in exchange for investing in U.S. projects, according to a 2015 report from property brokerage Savills Studley Inc. “The billionaires need the security of a new passport,” said Hu Xingdou, an economics professor at Beijing Institute of Technology. “Anyone could become a criminal overnight.” |

|

|

|

|

| 实用资讯 | |

|

|

| 一周点击热帖 | 更多>> |

| 一周回复热帖 |

| 历史上的今天:回复热帖 |

| 2016: | 巫婆正式对慌兮兮老全宣战啦,加上五香 | |

| 2016: | 俺可以接着当牧师,不过俺已经真的觉得 | |

| 2015: | NND,就因为俺认为学生宿舍可以不装空 | |

| 2015: | 男人梦中:前天去皇后镇拍的,我发现 | |

| 2014: | June 15,上山遛完腿,回家几分钟后, | |

| 2014: | 祝天下父亲们父亲节快乐,虽然挺肉麻的 | |

| 2013: | 珍曼: 老男人的魅力(1) | |

| 2013: | 外嫁女快讯:文革邓魔道客和法国前总统 | |

| 2012: | 宋高宗杀岳飞,至今找不到充分理由 | |

| 2012: | 今天有个叫什么中华正义军的网友,写了 | |