Palm 給出的教訓

Palm一度曾經是華爾街的寵兒,一度被人視為微軟“勁敵”的候選公司,也曾經一度讓我在短短幾天時間裡見證了什厶叫做“暴發戶”。當年我用20丌美元熱炒Palm的期權,在一個星期的時間裡將賬戶的價值拉升到百丌美元以上。結果,來的快,去的也快,在我還沒有搞明白那厶多“不義之財”從哪裡來的時候,就很快“退潮”消失了。

豬終究還是豬,不可能變成狗和貓的。一個企業的失敗,有着內在的本質上的問題,不是幾個分析和調整就能夠解決的。企業的失敗,很多時候實際上就是企業文化失敗的表現。企業文化的形成不可能一僦而僦,企業文化的調整,就像是冰凍三尺非一日之寒,也不可能在一個陽光明媚的下午就全部化光。

企業的失敗,有時候還真的有着某種必然性。今天的Palm,再一次證明了這點。作為投資者,不應該對於失敗者的起死回生抱有太多的希望。那種機會成功的幾率太小。

該公司股票95%由機腹投資中擁有,也就是說,普通投資者對它幾乎沒有興趣。

同時,該股票的賣空比例是45%!有接近一半的公司股票被“好事者”從“忠實”的投資者手中借出來給賣掉了。如此之多的人不看好公司的未來。如此之高的比例,也是少見的。一旦有人出價購買這家爛公司,這些沽空者就會不得不進場買入自己先前賣出的股票,結果就會是大幅拉升股價。好事、壞事,在這裡也就是站立在刀刃上的雞蛋了。

分析人士估計,在未來三年裡,該公司都沒有盈利的希望,而且,現在燒起現金的速度,比目前北方燒木材烤火的速度還要快。

公司的股價已經低於去年金融危機之時,“世紀末日”之刻。每天接近五分之一的股份轉手,說明不少人在搞短線操作。對於一家95%的股份為機腹投資中持有的公司股票來說,這到底意味着什厶呢?

不過,在去年9月股價在16.25美元時,還有三位公司內部人士花掉一億多美元購買了公司六千多丌股的股票。如此大量的購買,顯示了公司內部對公司前景的信心。如果你也基於這種信心跟進,並且一直持有到現在的話,在6美元一股的價位,估計你可能也就是“無話可說”(Speechless)了。很多看似利好的指標和信號,也不是投資者可以隨便相信的。

現在公司唯一的希望,看來就是有人出個價將自己收為“二奶”了。天底下有這厶“好心”的漢子嗎?讓我們拭目以待。

下面的文章告訴我們,如果大家留心一點,許多公司的問題在股價下跌顯示之前就可以感覺到。你的直覺和敏感,將會為你節省下來很多錢,甚至是給予你很多賺錢的機會。那些勇敢地賣空Palm股票的人看來是大賺了。

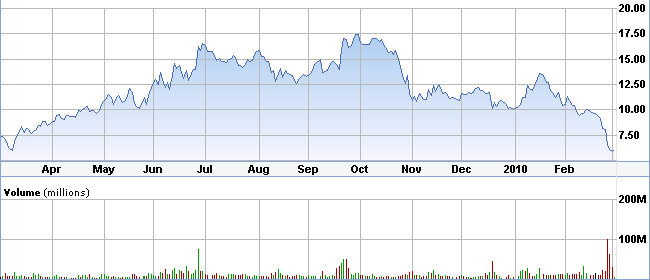

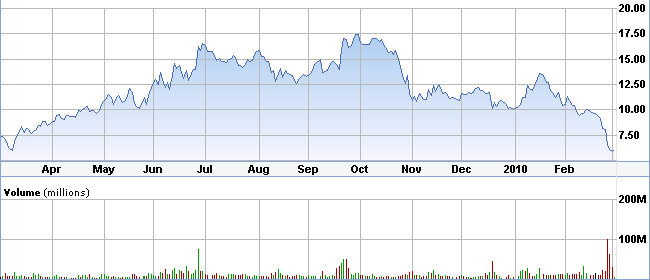

Palm一年期股價變化圖

附錄∶Struggling Palm may be an acquisition target

3/2/10 | Marketwatch

SAN FRANCISCO (MarketWatch) -- Last week, investors saw about half a billion dollars in the market value of smartphone developer Palm Inc. disappear. Poof. Gone. Bye-bye.

Investor confidence, though, had been slipping for weeks, long before the big bombshell hit on Thursday, in the form of a revenue warning for the February quarter. Some on Wall Street had begun theorizing, based on retailer checks and other observations, that Palm's (PALM) new smartphones weren't quite the runaway hits investors were hoping for.

These fears were then confirmed when the Sunnyvale, Calif.-company warned on Thursday that its bet-the-company smartphone family, designed around its webOS software, was seeing "slower-than-expected consumer adoption." Fiscal third quarter revenue is now seen with a shortfall of around $80 million to $100 million. See full story on Palm's earnings warning.

For those counting on a big Silicon Valley turnaround under Palm's new management team, a big cash infusion in late 2008, and a well-received product lineup that started with the Pre -- launched, fittingly on the anniversary of D-Day -- hopes may be dashed.

"I think there is no second chance," said Trip Chowdhry, a Global Equities Research analyst. "They had a golden opportunity...They just surrendered it."

Because of Palm's cash burn rate and its ongoing losses, investors fear it could eventually face a liquidity crunch. It is now being talked about as a potential takeover target. And the most likely acquirers could be computer makers in need of a better foothold in the faster-growing mobile space.

"When you look down the road, there is going to be a reckoning between smartphones and notebooks and netbooks," said Chris Hazelton, research director, mobile and wireless at the 451 Group. "These PC makers need to look at where computing is going and a good portion of computing is going mobile. And Palm is a very good asset."

The most-oft cited PC makers with a marginal presence in mobile computing are Dell Inc. (DELL) and Hewlett-Packard Co. (HPQ). Dell, however, might have too much on its plate, as it is trying to recoup its lost market share in the PC business and look for growth in services with its recent acquisition of Perot Systems. The company also lifted the wraps on its own smartphone earlier this year.

But H-P is another story. While its PC business saw units of notebooks and desktop PCs grow in the double-digits last quarter, its handheld business fell. It sells expensive smartphones running Microsoft Corp.'s (MSFT) Windows mobile software under the old iPAQ brand it purchased in its acquisition of Compaq Computer.

The numbers are telling. Handheld sales in H-P's most recent quarter, ended January 31, fell to an abysmal $25 million, down sharply from $57 million a year ago.

Surely numbers-driven Chief Executive Mark Hurd is looking for ways for H-P to take advantage of the boom in smartphones. Buying Palm could be a way for H-P to get into the market for lower cost devices. It might have to abandon Windows, or offer two families of devices. H-P has often juggled competing product lines, diverse chip architectures and operating systems.

H-P has also shown more marketing savvy targeting products directly to women. Women are also a big installed base Palm has been trying to retain with the Pre. Its strange, laughable television ads and a mirror underneath the pull-out keyboard were some of Palm's not so successful attempts. See column on Palm ads here.

On the other hand, H-P's partnership with fashion designer Vivienne Tam and the resulting clutch netbooks were at least well-received stylistically, if not for their computing prowess (but then netbooks are not supposed to do very much).

In general, H-P has much more consumer marketing heft than Dell, and could help distinguish Palm in the fiercely competitive smartphone arena. Just a few years ago, it rebooted its PC business with redesigned systems, a huge focus on mobile, and a major campaign to make the PC personal again. These efforts helped the company trounce Dell, restore profitability, and become the world's largest PC maker.

At least two of the executives behind some of those moves have some connections to Palm. Todd Bradley, who heads up H-P's PC business, was previously the CEO of PalmOne, back when that business focused on Palm hardware. Bradley stepped down in 2005. Before that, Palm was also briefly part of 3Com Corp., (COMS), before it was spun off in an IPO in March, 2000. Last year, 3Com agreed to be acquired by H-P in a deal valued at $2.7 billion.

An H-P spokeswoman declined to comment.

Some analysts don't necessarily believe, however, that even a downtrodden Palm is a good deal. The company has a current market cap of about $1.2 billion, including the value of its preferred shares owned by private equity investor Elevation Partners.

"We do not believe there would be strategic buyers of Palm at current levels," wrote UBS analyst Maynard Um. He added, though, that if its valuation falls below $1 billion, there could be interest.

Other analysts were even less optimistic about its future. Matthew Hoffman, a Cowen & Co. analyst, wondered if Palm's webOS software is the first casualty of Google Inc.'s (GOOG) competing Android software. He wrote that Palm's revenue shortfall indicates that its "window to establish a lasting market presence with webOS may be closing."

Jim Suva of Citigroup does not see Palm as a target for H-P, Dell, Nokia Corp. (NOK), Microsoft or Motorola Inc. (MOT), noting his concern about the company's high cash burn rate. He added that he does not see profitability for Palm in his three-year model.

But if its shares get any cheaper, I don't think you can rule out some sort of deal.