| 汪翔:买点普天寿(PRU)股票吧 |

| 送交者: 汪翔 2010年04月14日12:23:40 于 [股市财经] 发送悄悄话 |

|

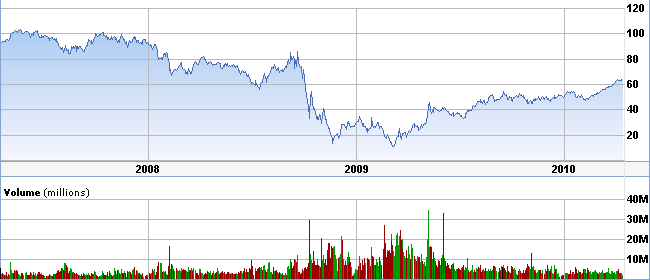

买点普天寿(PRU)股票吧 标准普的分析师很喜欢这家公司,给予的是五星级的强力推荐。目标价格在75美元。理由,一则是公司的业务稳定而且在今年估计有20%的成长潜力。再者,我觉得,在公司花355亿美元巨资购买了美国国际集团旗下的友邦等亚洲优质资产之后,它的未来潜力会更大。 如果你足够勇敢,你也可以购买它在2012年1月到期的50美元的CALL,你支付的价格在19.2美元。如果你特别保守,就在同时再卖出同期同样数量70美元的CALL,每股收回8.2美元。这样一来,你的成本在每股61美元。如果股价上升到70美元以上,你获得的是20/11=1.818,大概是80%的投资回报。

附录一∶普天寿股份将在香港挂牌交易 Prudential In Talks With Investors On Share Transfer To HK 4/5/10 | Dow Jones U.K. insurer Prudential Plc (PRU.LN) is in talks with large investors to transfer some shares to Hong Kong, the Financial Times reported late Monday, citing sources. The FT, on its Web site, says the shares need to be transferred to ensure the company's stock can be traded on the local exchange in April. Shares must be available to trade on the Hong Kong exchange from the first day of listing, the FT said. 附录二∶普天寿的“广告”∶亚裔美国人没有准备好退休资金 Asian Americans Not Financially Ready for Retirement 4/13/10 | BusinessWire Most Asian Americans are not ready for retirement and are not seeking professional guidance, a new study by Prudential Financial, Inc. (NYSE:PRU) shows. Asian Americans were hit hard by the recent economic turmoil, with approximately 8 in 10 indicating their savings and investments were impacted by the sharp market downturn of 2008 and 2009. Yet the study, Asian Americans on the Road to Retirement, found they continue to remain focused on achieving ambitious retirement goals, while balancing other responsibilities such as providing for family members. "Asian Americans need to address the gaps that exist between the goals they've set and the lifestyle in retirement they can now expect to achieve. This is particularly critical for those nearing retirement," said John Greene, president of Agency Distribution at Prudential. "Some 43 percent have less than $50,000 in retirement savings, and many have little or no understanding of the financial options available to them." Despite the traditions of the "Asian belief system," which suggests the elderly will be cared for by family, barely 1-in-3 are looking to family for "retirement security," and just 20% are counting on the government or Social Security to take care of them. Currently, their retirement plans lack a number of important components; additional findings indicate that: -- Only 27 percent have a formal written plan in place for retirement. -- Life insurance is a key concern for this market, yet most need guidance and a deeper understanding of the products available on the market. -- Only a small percentage of those surveyed understand the role that investment vehicles like mutual funds or annuities can play. While 98 percent of those surveyed think retirement success depends on their ability to plan well, only 18 percent have engaged in a conversation with a financial professional. "Much like the overall population in the U.S., Asian Americans need to broaden their knowledge about the financial products and services that can help mend their portfolios and achieve their retirement goals," Greene said. Asian Americans on the Road to Retirement, an online survey, was conducted in July 2009 and polled a total of 656 Asian Americans who were sole or joint financial decision makers, between the ages of 25 to 65 and had total household income of $50,000 or more. The margin of error is +/-3.8% at the 95% confidence level. For more information download a copy of Asian Americans on the Road to Retirement. Prudential Financial, Inc. (NYSE: PRU), a financial services leader with approximately $667 billion of assets under management as of December 31, 2009, has operations in the United States, Asia, Europe, and Latin America. Leveraging its heritage of life insurance and asset management expertise, Prudential is focused on helping individual and institutional customers grow and protect their wealth. In the U.S., the company's Rock symbol is an icon of strength, stability, expertise and innovation that has stood the test of time. Prudential's businesses offer a variety of products and services, including life insurance, annuities, retirement-related services, mutual funds, investment management, and real estate services. For more information, please visit www.news.prudential.com. |

|

|

|

| 实用资讯 | |