| 關於岩頁油氣田的一點基本常識 |

| 送交者: 遠古的風 2013年01月02日14:53:14 於 [股市財經] 發送悄悄話 |

|

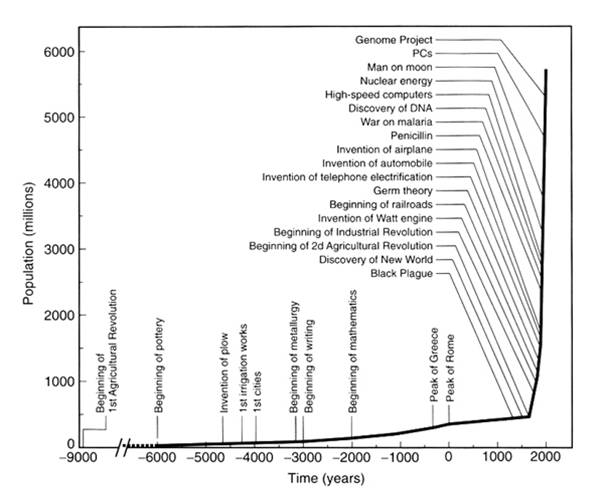

http://rt.com/business/news/shale-gas-oil-usa-589/ “The second thing is that nobody thinks very much about is the decline rates shale reservoirs experience. Well, I’ve looked at this. The decline rates are incredibly high. In the Eagleford shale, which is supposed to be the mother of all shale oil plays, the annual decline rate is higher than 42%,” according to Bill Powers, author of the book “Cold, Hungry and in the Dark: Exploding the Natural Gas Supply Myth.” “They’re going to have to drill hundreds, if not thousands of wells in the Eagleford shale every year to keep production flat. Just for one play, we’re talking about $10 or $12 billion a year just to replace supply. I add all these things up and it starts to approach the amount of money needed to bail out the banking industry,” Powers concluded. For more: Arthur Berman: The second thing that nobody thinks very much about is the decline rates shale reservoirs experience. Well, I’ve looked at this. The decline rates are incredibly high. In the Eagleford shale, which is supposed to be the mother of all shale oil plays, the annual decline rate is higher than 42%. They’re going to have to drill hundreds, almost 1000 wells in the Eagleford shale, every year, to keep production flat. Just for one play, we’re talking about $10 or $12 billion a year just to replace supply. I add all these things up and it starts to approach the amount of money needed to bail out the banking industry. Where is that money going to come from? 更加詳細的岩頁油氣田的平均衰減率計算在下面的文章中: Mark Anthony: But one thing they could not hide is that in quarters after quarters, the producers have consistently spend several times higher on capital spending, than the revenue they take in. Producers continue to borrow more and more on debts in order to continue their well drilling programs. Is a business profitable, if it continues to borrow more debts quarter after quarter, and it continue to spend several times more on capital spending, than the revenue it takes in? This is neither profitable, nor sustainable. I can see that when the banks get suspicious and stop lending money, then the shale industry will collapse. As I stated many times. The shale gas and oil adventure is deeply un-profitable. The “cheap natural gas replacing coal” is a pipe dream. Investors should bet their money on the rebound of the coal sector, not on the false promise of shale gas or shale oil. 除了高衰減率,頁岩油氣田真正面臨的問題是:頁岩油氣田的能源產出與能源投入的比率比普通的油氣田要低很多(見下圖): 這說明:隨着普通化石能源的枯竭,使用非常規能源來替代人類的能源消耗缺口,要麼帶來居高不下的能源價格(拖累經濟的發展),要麼過度過快地消耗掉剩餘的資源(為了獲得跟以前相同量的能源需要投入更多的資源)。 現在,面對人類最大的問題是:一旦出現能源危機,整個人類如此多的人口該怎麼維持下去呢? 【推薦閱讀】The Long Emergency The Big Flatline 高油價的政治經濟後果 |

|

|

|

| 實用資訊 | |

|

|

| 一周點擊熱帖 | 更多>> |

| 一周回復熱帖 |

| 歷史上的今天:回復熱帖 |

| 2012: | 飛狐:“瘋狂”的蘋果 | |

| 2012: | 2012的股市能夠給投資者多少期待? | |

| 2011: | 中概股的欺詐行為是一個問題? | |

| 2011: | PPL昨天上了FOX BUSINESS NEWS | |

| 2009: | New Year first opportunity... | |

| 2009: | 這裡的熊客最近如何啊,PG燒胡了吧 | |