美利堅銀行要還錢了:好事還是壞事?

美利堅銀行因為實在是找不到一位願意在薪水加獎金上低就的人,來接替即將離職的CEO。

在實在是沒有辦法的情況下,想先將就着將借政府的450億美元還掉。只有還了這筆政府債務之後,它才能夠想怎麼付錢給它的老總就怎麼付,沒有人能夠管得着。

對於國家,這當然是件好事,納稅人少了一筆巨款的風險,雖然也少在這筆巨款上賺高達10%的年利息,也就是每年納稅人少得45億美元。

對於美利堅銀行,一方面是節省了這筆45億美元的利息開支,但同時,卻導致了必須多支付管理層的結果,股東不得不為此埋單。

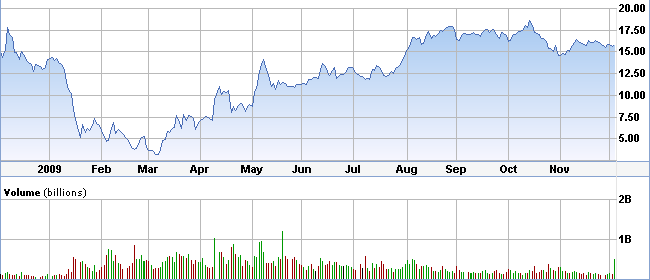

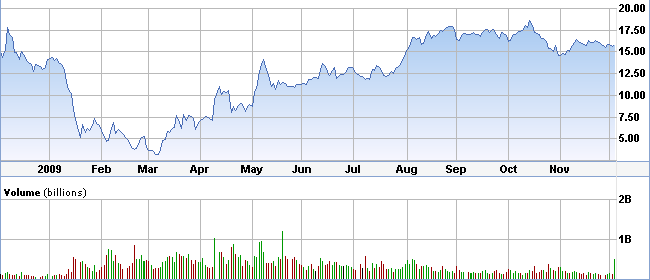

表面上看,似乎是,銀行有能力付清應該是一件好事,同時也節省了45億美元的開支。既省錢又表明了實力,很多人就是以此為基礎來看漲BAC的股票,股價也因此而在富國銀行下跌時開漲。

問題是,這樣的結果就是股東股份是稀釋,同時,銀行自己到底是已經有能力,還是實在是沒有辦法必須這樣做?

對比富國銀行不着急的態度,看來,美利堅銀行“沒有辦法之下的選擇”的成分更重一些。

這種勉為其難的做法,對於股東到底是件好事還是件壞事?大家可以琢磨一下。

【附錄】Wall Street Cheers BofA TARP Move And Looks To Who Is Next

12/3/09,By Brendan Conway ,DOW JONES NEWSWIRES

NEW YORK (Dow Jones)--Wall Street breathed a sigh of relief Thursday morning after news of Bank of America Corp.'s (BAC) agreement to repay $45 billion in federal bailout funds, with most analysts calling the deal a sign that government interventions are near an end for at least one major bank.

Now, some analysts are looking ahead to see which other large financial companies may be next to repay funds borrowed under the Troubled Asset Relief Program. Pressure on firms including Wells Fargo & Co. (WFC) and PNC Financial Services Group Inc. (PNC) is now likely to ratchet up, analysts said, though some stressed the expectation that they follow up is premature in at least some cases.

Wells Fargo doesn't appear to be pursuing repayment as aggressively as Bank of America, analysts at Sanford C. Bernstein & Co. said. They predicted the company could potentially "earn out" of its bailout debt in a few quarters.

"We caution against a rigid read-across of the BofA situation to all other TARP banks," Bernstein wrote in a note to clients.

One key for Wells Fargo will be how the government takes into account the impact on earnings of acquisitions banks have undertaken since the financial crisis erupted. Those acquisitions can enhance long-term earnings but may also make it harder to pay back the government in the near term.

Citigroup called the government's treatment of acquisitions "a huge swing factor," along with whether authorities apply differing standards for capital levels at different banks.

Citi's analysts wrote that they think Bank of America and J.P. Morgan Chase & Co. (JPM) are "held to a higher standard" when it comes to capital levels.

A Wells Fargo spokeswoman said in an email, "We will work closely with our regulators to determine the appropriate time to repay the government's investment in Wells Fargo while maintaining strong capital levels."

At least two firms upgraded Bank of America's stock in the deal's wake. Calyon Securities analyst Mike Mayo, noted for prescient bearish calls on banks in the financial crisis and in the 1990s, and FBR Capital Markets each raised the shares to an outperform rating.

At least one firm said it now expects Bank of America will fill its executive suites sooner rather than later. The bank has run into a series of roadblocks replacing outgoing chief executive Kenneth Lewis, who is expected to step down at the end of the year.

Being freed of government executive-compensation restrictions could mean a new top executive at Bank of America "potentially before year-end," FBR Capital said.

The immediate impact on shareholders of the deal's $18.8 billion in new equity--which might be expected to dilute the value of their stock--was disputed.

Credit Suisse and Goldman Sachs analysts said they expect the new shares to dilute shareholders by about 10%. But others said the dilutive impact of the new stock would be offset by money saved in dividend payments to the government.

Most seemed to consider any shareholder dilution as secondary, though.

The deal "relieves the intense regulatory and political scrutiny tied to its receipt of government money," Credit Suisse analysts wrote, and for that reason should be considered a positive.

Shares of Bank of America were up 2.4% to $16.03 in recent trading.